Templeton says he can render users lien waivers that all of this new subcontractors try paid-in complete from the particular milestones while the stop away from work.

An increase thread can be requested by the home owners, demanding the task is satisfactorily accomplished with regards to the price words. The connection you will increase the price of your panels from the dos-5 %, however the extra cost will probably be worth the new comfort, particularly to the high perform.

5 – Improve your homeowner’s insurance coverage

In case the home improvements are essential to increase their residence’s worthy of by 6-12%, it is best to evaluate together with your insurance carrier making sure your own enhanced house is protected during the a loss of profits, Horton claims.

A great family’s insurance broker may also know if this new contractors has actually enough insurance coverage to pay for potential losses of course, if the new homeowner’s insurance policies will be increased. Text throughout the price to the company could need to become added to make sure the contractor’s insurance is the key insurance policies and that they waive the ability to file states contrary to the resident together with homeowner’s insurance plan.

Whatever a lot more homeowner’s insurance policies you get, cannot wait until after the repair to boost their publicity. Belongings can also be burn off towards floor, eg, throughout the design performs, and extra insurance policies could loan places Onycha help protection for example losings.

6 – Add life insurance policies

Coverage will be the last thing you’re interested in just before your upgrade your house, but it is something to believe whenever contributing to the value of your property and taking right out a house guarantee mortgage. Including a great deal more personal debt to your life is reasonable so you can check your life insurance policy and you may opinion they to make sure you may have enough publicity to repay financing for folks who perish, claims Rick Huard, older vice-president out of consumer lending at TD Bank.

House Collateral Money and you can Building work

Since your own home’s bathroom are dropping aside otherwise that home demands remodeling is easy sufficient to decide.

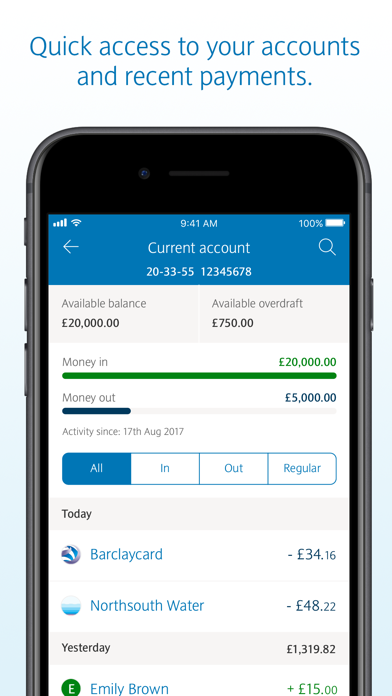

A few common an effective way to loans home improvements are a property guarantee mortgage, and you will property security credit line, often referred to as an excellent HELOC. One another wanted with some guarantee of your home, constantly at least 10%.

Eventually, you’ll get a better bathroom, home or any other section of your home to enjoy, together with residence’s really worth might have to go right up, though only a few renovations really works covers itself by broadening an excellent residence’s value.

“You will find specific worth during the upgrading a property on your own play with,” says Wendy Cutrufelli, transformation and you can revenue administrator toward mortgage division regarding Lender away from south west into the San francisco bay area.

HELOC

This is the most well known selection for remodeling a home, partially since the interest is gloomier than just a house collateral mortgage, and because the latest personal line of credit can be utilized over ten decades – called the mark several months – and you may appeal is only billed for the amount taken out when you look at the the period.

This may be useful for individuals who expect to need an excellent number of years to upgrade your home, and commonly yes just how much currency you want.

Interest rates change in length of an effective HELOC, and will transform on intervals such as quarterly, twice a year otherwise a year, Cutrufelli claims. Most recent prices go for about 5 percent, having a house security financing price 2 per cent highest, she says. The fresh worst situation condition having a HELOC interest is to try to getting about of up to a credit card, doing 18 percent attract, she claims.

Following ten-seasons draw several months, this new debtor enjoys 2 decades to repay the complete financing, even when they can refinance the changeable HELOC rates with the a fixed rates mortgage.