Share a card account? Then you definitely display credit file pointers as well. An economic connection is actually anyone you’re about through joint profit or a mutual borrowing from the bank membership. There are several prominent misunderstandings about monetary connectivity just discussing an address which have people or even having a wedding so you can her or him (yet not having one mutual borrowing from the bank) does not make certain they are a monetary user.

You are able to become financially on the individuals for many who:

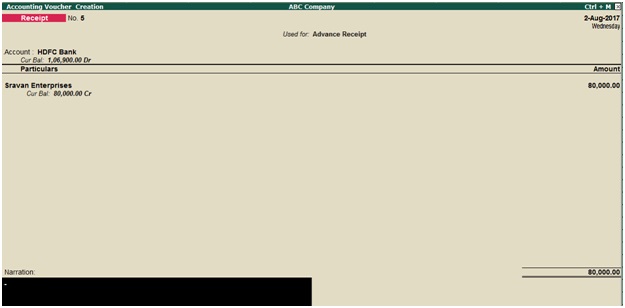

- Unlock a mutual savings account together

- Apply for credit together, such as for example home financing or mortgage

- Rating a joint State Court Wisdom

1. Your credit history suggests the person you display earnings having

Your credit history includes information about things like your own membership, money and you can costs. For many who express cash with somebody, they’ll certainly be filed in your report as your ‘financial associate’.

2. Relationship does not carry out an economic connection

Getting married doesn’t necessarily link you to definitely your own wife or husband’s earnings. You should buy partnered, get into a civil union, move in along with her, and even capture someone’s surname without causing a monetary organization to the your credit report.

In addition to this, marrying some body does not always mean its expenses feel yours. You’re not legitimately guilty of the partner’s financial obligation, unless it’s on your own name as well. If you do have combined finances along with your mate, it is possible to continue to have independent credit file they are going to you need to be related to both. Observe that using son maintenance will not number because common cash.

step 3. Debt lovers can affect your ability to track down borrowing

Enterprises take a look at details about your credit history after you make an application for credit, such as for instance home financing or mortgage. This gives him or her an idea of how well your manage your funds https://paydayloansconnecticut.com/terryville/, and helps them choose whether or not to give you money.

Your financial couples appear on your declaration, and you may companies can get glance at its credit score when deciding whether or not to approve you. For the reason that debt partners ple, whether your partner’s become made bankrupt, businesses is generally worried which you yourself can have to help them repay the bills before you pay-off your.

cuatro. It’s important to take care of the credit history

Your credit rating reflects exactly how credible youre with borrowing from the bank and you can has an effect on what you can do to borrow funds. Whether or not your financial affiliate has actually good credit, it is critical to look after their. It is because:

- If you have a reduced score, it does adversely connect with their lover’s ability to get credit, regardless if you are not using with her.

- Businesses can get reject a loan application getting combined credit (elizabeth.g. a contributed financial) if the just one of you possess a reduced credit history.

- For people who separation, get divorced, otherwise your ex partner dies, you might have to get borrowing due to the fact an individual.

You will find some activities to do to improve their credit get, and spending expenses on your title and receiving your own borrowing from the bank cards. You can check the Experian Credit rating with a totally free Experian membership. The better their rating, the much more likely you are discover borrowing in the an effective pricing.

5. You should buy monetary relationships taken from their declaration

For those who not any longer display profit along with your monetary affiliate, you could potentially ask Experian in addition to almost every other credit reference firms (Equifax and you will Callcredit) to remove him or her out of your credit history. Get in touch with us, and stay prepared to render research that economic relationship have finished.

If you have had a separation otherwise divorce proceedings, but still share home financing with your old boyfriend-partner, we could possibly be able to crack the latest connection ranging from your if you have been living apart for over six months. In cases like this, you will have to romantic any common earnings using them, instance shared bank accounts.

6. Huge life events are a great time for you to look at your financial contacts

You will need to learn your financial contacts and keep maintaining them up-to-date, because they can features an enormous effect on you and your connections. It’s best to check them if the:

- You may be swinging home otherwise purchasing your very first house

- You will be transferring with a partner, marriage, or typing a civil commitment

- Someone close for you (the person you could be finically associated with) have died

You’ll find debt partners on the Experian Credit report. When you need to have the ability to look at the declaration daily, and you can discovered report alerts to certain change, think taking an effective CreditExpert reduced membership.